Highlights

- ADQ will acquire a 49 percent stake in Plenary Group, an Australia-based leading independent investor, developer and manager of public-private infrastructure projects

- The deal will also include the establishment of a co-investment platform between Plenary Group and ADQ, with a focus on high-growth geographies including the GCC region, the Middle East, and Central Asia

- The partnership will support ADQ in further bolstering its track record in investing in public and social infrastructure in the UAE and the abroad

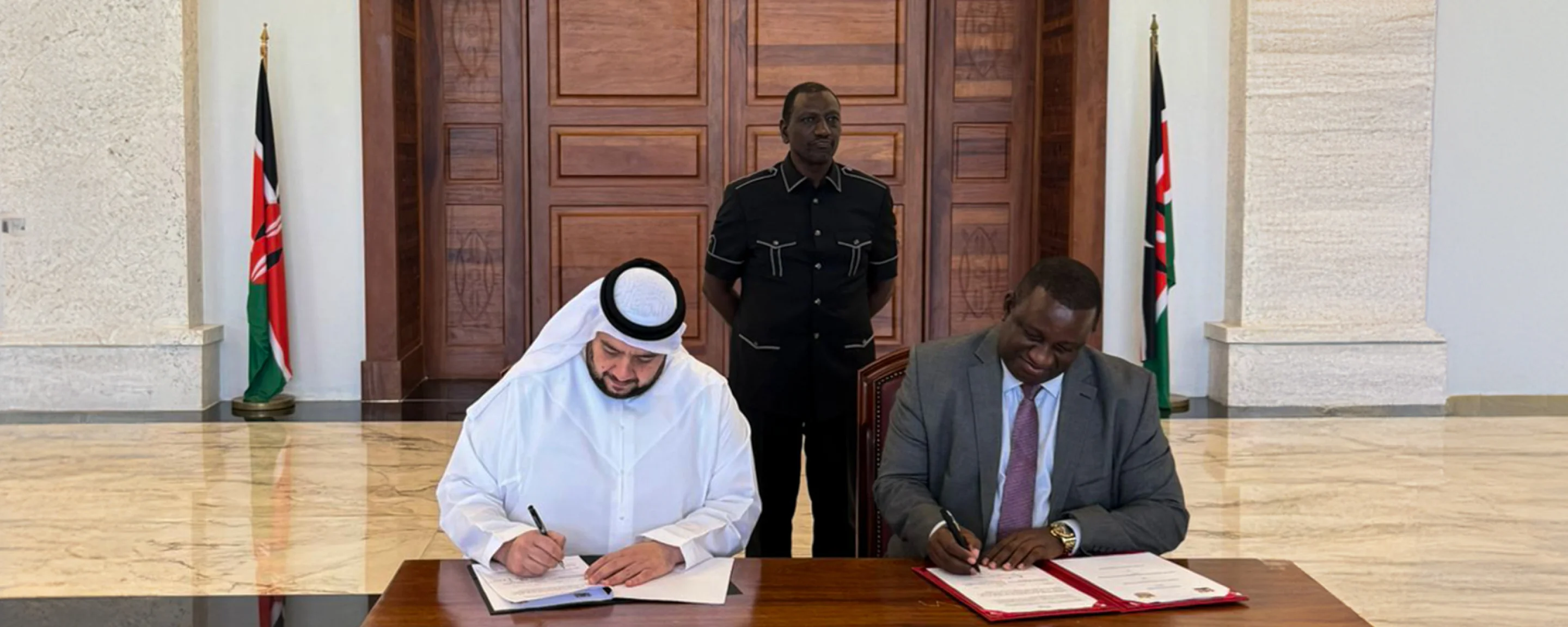

ADQ, an Abu Dhabi-based investment and holding company, and Plenary Group (Plenary), a leading independent investor, developer and manager of public-private infrastructure projects headquartered in Australia, today announced a partnership aimed at expediting the expansion of public and social infrastructure through strategic investments.

ADQ will acquire a 49 percent stake in Plenary, including all shares currently owned by Canadian pension fund Caisse de dépôt et placement du Québec, which will continue to be heavily invested in a range of Plenary’s Australian assets and remains the major shareholder in Plenary’s separate Americas business.

The primary capital contribution by ADQ will be used to accelerate Plenary’s growth ambitions across its key markets in Australia, the Middle East, Asia, the UK and Europe.

As part of the partnership, Plenary and ADQ will also establish a co-investment platform which will focus on public and social infrastructure opportunities in high-growth geographies including the GCC region, the Middle East and Central Asia. The partnership will allow ADQ to further bolster its track record in investing infrastructure assets to accelerate economic development in the UAE and abroad.

Established in 2004, with a portfolio of 21 assets under management valued at over USD 25 billion across Australia and the Middle East, Plenary has steadily grown to be recognized as a market-leading investor, developer and manager of public infrastructure, successfully deploying its business model internationally.

Hamad Al Hammadi, Deputy Group Chief Executive Officer of ADQ, said: “This collaboration, marking our inaugural venture in Australia, underscores ADQ’s commitment to developing partnerships that complement our investment strategy, which aims to create long-term value and generate sustainable financial returns. We are confident that our partnership in Plenary will unlock significant opportunities to contribute to the development of state-of-the-art infrastructure assets, boosting economic growth and social welfare in the target geographies. ADQ’s existing portfolio of infrastructure assets, many of which are emerging as national champions, will serve as a catalyst to leverage the significant potential of public-private partnership projects together with Plenary, a leader in its field with a proven track record of delivering successful infrastructure projects globally.”

John O’Rourke, Chairman and Founder of Plenary Group, said: “ADQ’s investment in Plenary will help accelerate our growth in Australia and internationally while the co-investment platform will allow us to scale our activities in the Middle East. ADQ has a leading position in the Middle East region and increasingly on a global scale, with an impressive portfolio of infrastructure assets. Critical to our partnership, it is committed to supporting the further development and operation of public infrastructure in partnership with Plenary. We are confident that our culture and experience, combined with ADQ’s capability and investment acumen, will allow us to seize new opportunities and establish ourselves as a leader in our growth markets.”

ADQ’s expansive portfolio of infrastructure assets encompasses key sectors of the economy, including transport and logistics, energy and utilities, as well as real estate.

Plenary has delivered strong early momentum in the Middle East since establishing a presence in 2022, notably securing the UAE’s first schools public-private partnership which encompassed the financing, design, procurement, construction, commissioning and 20-year operations and maintenance of three state-of-the-art school campuses at Zayed City in Abu Dhabi.

The transaction is subject to customary closing conditions and necessary regulatory approvals.

About ADQ

Established in 2018, ADQ is an Abu Dhabi-based investment and holding company with a broad portfolio of major enterprises. Its investments span key sectors of the UAE’s diversified economy including energy and utilities, food and agriculture, healthcare and life sciences, and mobility and logistics, amongst others. As a strategic partner of Abu Dhabi’s government, ADQ is committed to accelerating the transformation of the Emirate into a globally competitive and knowledge-based economy.

For more information, visit adq.ae or write to media@adq.ae. You can also follow ADQ on X, Instagram and LinkedIn.

Direct to your inbox

ADQ News and Insights delivered directly to your inbox

.jpg)